Economics

The Impact of Trump’s Tariffs on U.S. Economic Growth Projections

Introduction to Tariffs and Economic Growth

Tariffs are taxes imposed by a government on imported goods. The primary purpose of tariffs is to protect domestic industries from foreign competition, thereby encouraging local production and preserving jobs. By making imported goods more expensive, tariffs can discourage consumers from purchasing foreign products, which can benefit domestic manufacturers. However, tariffs can also lead to higher prices for consumers and may provoke retaliatory measures from trading partners.

In the context of international trade, tariffs play a significant role in shaping the economic relationships between countries. They influence trade balances, affect the prices of goods, and can lead to either economic growth or contraction, depending on various factors. These factors include the elasticity of demand for imported goods, the state of the domestic economy, and the competitive landscape within specific industries.

Economic growth projections refer to forecasts made by analysts regarding the expected growth of a country’s economy over a specific period. These projections are influenced by a multitude of variables such as consumer spending, business investment, government expenditure, and net exports. Additionally, the economic policies of a government, including trade policies like tariffs, play a crucial role in shaping these projections.

The imposition of tariffs can create uncertainty in the economy, affecting business confidence and investment decisions. Increased costs associated with tariffs may lead businesses to reevaluate their growth strategies, impacting employment rates and overall productivity. Thus, understanding the dynamics of tariffs is essential to grasp their potential impact on economic growth projections.

This discussion aims to explore how the tariffs implemented during Trump’s administration have affected the U.S. economy, particularly in relation to economic growth projections. By analyzing the implications of these trade policies, we can gain insight into the broader economic landscape and the potential future trajectory of the U.S. economy.

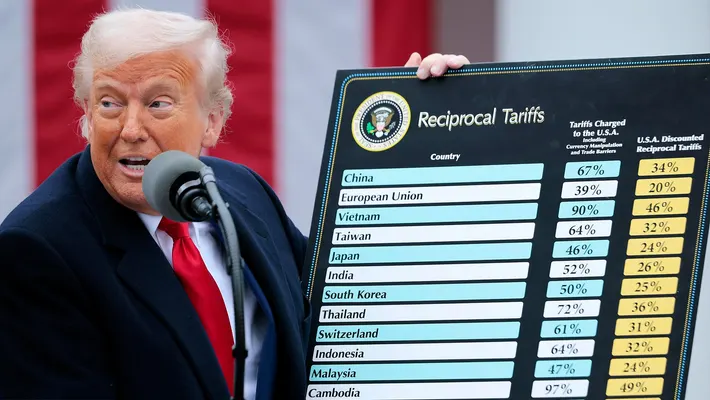

Overview of Trump’s Tariff Policies

During his presidency, Donald Trump implemented various tariff policies that significantly influenced the U.S. economy and trade relations with other countries. These policies primarily aimed to protect American manufacturing by imposing tariffs on a wide array of imported goods. The most notable tariffs targeted categories such as steel, aluminum, and a vast selection of Chinese goods, reflecting a strategic approach to bolster domestic industries.

One of the major milestones of Trump’s tariff initiatives occurred in 2018 when the administration levied tariffs of 25% on steel and 10% on aluminum imports. This decision was justified by the administration on national security grounds, suggesting that dependence on foreign metals could undermine U.S. military and economic strength. These tariffs were met with mixed reactions from various sectors, highlighting a complex interplay between protectionism and free trade principles.

In addition to steel and aluminum, the Trump administration aggressively targeted Chinese imports, particularly those falling under the umbrella of technology and consumer goods. Beginning in July 2018, a series of punitive tariffs were imposed on $250 billion worth of Chinese products, sparking significant tensions between the two economic giants. The rationale behind this move was to rectify what Trump termed as unfair trade practices and intellectual property theft. These tariffs aimed to create leverage for negotiations with China, leading to the Phase One trade deal signed in January 2020. However, the implementation of these tariffs had far-reaching implications, affecting U.S. consumers and industries reliant on imported components.

Overall, Trump’s tariff policies sought to reshape trade dynamics by prioritizing American interests, which in turn, affected international relations and global market interactions. The long-term impact of these policies continues to be a topic of analysis, as they led to both heightened trade tensions and discussions on the future of U.S. economic strategy.

Short-Term Economic Impacts of Tariffs

The introduction of tariffs under the Trump administration has generated immediate effects on various sectors of the U.S. economy. One of the most notable consequences is the fluctuation of prices for goods directly affected by these tariffs. Products such as steel and aluminum became more expensive due to the increased costs associated with tariffs. Consequently, businesses relying on these materials faced higher operational expenses, which in many cases were passed on to consumers. This led to an uptick in prices for various consumer goods, ranging from automobiles to electronics.

Moreover, the potential disruptions in supply chains played a critical role in the short-term economic landscape. Companies that previously engaged in global sourcing encountered challenges as tariffs altered trade dynamics. Many U.S. manufacturers reported delays and increased costs when trying to secure components from foreign suppliers, which hindered production efficiency. Some businesses opted to move operations back to the United States to mitigate tariff impacts, although this transition often resulted in higher labor costs and initial investment challenges.

Sector-specific impacts varied across industries, with some facing significant downturns while others experienced growth. For example, the agricultural sector suffered as retaliatory tariffs from trading partners limited export opportunities. Farmers struggled with decreased demand for products such as soybeans and pork, exacerbating an already challenging economic environment. In contrast, domestic steel and aluminum producers benefitted from reduced competition, capitalizing on the tariff-induced market conditions. These varying impacts underline the complexity of tariffs and their unintended consequences across different sectors of the economy.

Ultimately, the short-term effects of tariffs on the U.S. economy underscore the intricate relationships between trade policy, consumer behavior, and business dynamics. Industries must navigate these ongoing challenges while adapting to a new economic reality shaped by tariff legislation. As businesses and consumers respond to fluctuations in the market, the ongoing monitoring of these economic indicators will be crucial to understanding the longer-term ramifications of tariffs.

Long-Term Economic Growth Projections

The implementation of tariffs under former President Trump’s administration has sparked substantial debate among economists regarding its long-term implications for U.S. economic growth. Tariffs, functions as taxes imposed on imported goods, are designed to protect domestic industries but often lead to unintended consequences. In the long run, the economic growth projections in the U.S. could be significantly altered due to these trade policies.

Economists have generally pointed out that the imposition of tariffs may lead to a rise in consumer prices. By increasing the cost of imported goods, tariffs result in consumers bearing the brunt of higher expenses, thus constraining disposable income and reducing overall consumption. According to various projections, this could detract from Gross Domestic Product (GDP) growth. For instance, the Congressional Budget Office (CBO) and other financial institutions have periodically revised their GDP growth forecasts in light of escalating trade tensions, attributing part of the downward modifications directly to tariffs.

Furthermore, tariffs can instigate retaliation from trading partners, potentially leading to a trade war that engenders further economic instability. As countries retaliate, U.S. exporters may face barriers in international markets, undermining growth opportunities for critical sectors of the economy. This cyclical pattern has raised concerns about long-term productivity gains, which are vital for sustainable economic expansion. A study by the National Bureau of Economic Research has suggested that prolonged tariffs could yield a net reduction in economic health, with estimates showing a substantial decline in GDP growth rates over the next decade compared to a scenario without tariffs.

In light of these considerations, the long-term economic growth projections of the U.S. remain precariously linked to trade policy decisions. The effects of tariffs on consumer behavior, supply chains, and international relations underscore the complexity of quantifying their impact on future economic health.

Consumer Price Index and Inflation Concerns

The relationship between tariffs and the Consumer Price Index (CPI) has garnered significant attention in recent years, particularly in light of economic policies established under the Trump administration. Tariffs, which are taxes imposed on imported goods, can influence domestic prices by altering the cost structure of products available in the market. When tariffs are applied to foreign goods, importers often pass on these increased costs to consumers, resulting in higher prices. Consequently, this dynamic can lead to noticeable shifts in the CPI, which measures changes in the average prices of a basket of consumer goods and services.

The implementation of tariffs led to rising inflation rates, sparking concerns among economists and policymakers. As tariffs increased costs for businesses relying on imported materials, these expenses inevitably trickled down to consumers. For instance, industries such as steel and aluminum experienced price hikes, which further affected sectors such as construction and automotive manufacturing. As a result, consumers faced elevated costs, impacting their overall purchasing power and spending habits.

As inflation rates rose, consumer behavior began to shift. Many households became more cautious, opting to limit discretionary spending in favor of saving, a response driven by uncertainties about future economic conditions. This change in consumer sentiment can pose broader implications for economic growth, as a decline in consumer spending can lead to reduced demand across various sectors. Furthermore, prolonged inflation can erode real wages, diminishing purchasing power and placing additional strain on household budgets.

In sum, the impact of tariffs on the Consumer Price Index highlights the intricate relationship between trade policy and inflation. The resulting fluctuations in consumer prices have far-reaching implications, influencing consumer behavior and, ultimately, U.S. economic growth projections. Understanding this relationship is crucial for assessing the effects of trade policies on both consumers and the economy at large.

Impact on Employment and Job Markets

Trump’s tariffs, introduced primarily to protect domestic industries, have led to significant changes in employment rates and the job market in the United States. As tariffs increased the cost of imported goods, domestic manufacturers were initially hopeful that they could capitalize on reduced competition. However, the precise impact on manufacturing jobs has been complex. While some industries, particularly steel and aluminum, experienced a temporary surge in employment due to tariff protection, other sectors reliant on imported components faced challenges that led to job losses. For instance, industries such as automotive and electronics struggled under the increased costs, which often translated to downsizing efforts.

The employment landscape in the services sector also felt the ripples of tariff implementation. Businesses operating in the service industry, such as restaurants and retail, faced higher prices from suppliers who in turn had to absorb the cost of tariffs on imported goods. This dynamic forced many service-oriented businesses to adjust their labor needs. Thus, while some sectors benefitted from a sudden increase in demand for local products, others were compelled to cut back on staffing to counteract the rising costs.

Moreover, the introduction of retaliatory tariffs by other countries further complicated the job market. Export-oriented industries that relied on international markets found themselves at a disadvantage as foreign partners imposed tariffs on American goods in response. Consequently, job stability in these sectors was jeopardized, leading to a contraction in employment opportunities. Overall, while some job creation occurred in specific sectors due to protective tariffs, the unintended consequences have fostered uncertainty in the labor market and have inhibited considerable job growth across the broader economy. This ongoing evolution emphasizes the intricate balance between protective measures and their ramifications on employment in the U.S. job market.

Sectoral Analysis: Winners and Losers

The implementation of tariffs under the Trump administration has had varying effects across different sectors of the U.S. economy. Understanding the nuanced impacts of these tariffs is essential for analyzing their overall economic implications. Notably, sectors such as steel and aluminum manufacturing have found themselves in favorable positions due to protective tariffs against foreign imports. The tariffs aimed to bolster domestic production have indeed resulted in increased prices for these manufactured goods, which, while beneficial for U.S. producers, have also led to higher costs for consumers and downstream industries that rely on these materials.

Conversely, the agricultural sector has experienced significant challenges in the wake of these tariffs. Many farmers have relied on exports to international markets, particularly to countries like China. In response to U.S. tariffs, these countries imposed retaliatory tariffs on American agricultural products, leading to a decline in sales and financial strain on farmers. While the U.S. government has introduced relief programs aimed at assisting struggling farmers, the long-term sustainability of these measures is uncertain and illustrates the difficulties faced by the agricultural industry in this context.

Additionally, the technology sector has seen mixed outcomes. Companies that rely on imported components for manufacturing goods have faced increasing costs, leading to decisions around price adjustments or shifts in supply chains. On one hand, domestic tech firms involved in semiconductor manufacturing could benefit from reduced foreign competition, but on the other, those reliant on global supply chains may find operations hampered by elevated costs and logistical challenges.

In this multifaceted landscape, it becomes clear that while certain sectors emerge as winners under Trump’s tariffs, others, particularly agriculture and technology sectors, grapple with adverse effects. This sectoral analysis underscores the complexity of tariff impacts and invites further discussion on the long-term implications for the U.S. economy.

International Trade Relationships and Global Economy

The implementation of tariffs under the Trump administration has significantly reshaped international trade relationships and contributed to the evolving landscape of the global economy. Initially aimed at protecting American industries from foreign competition, these tariffs prompted retaliatory actions from several trading partners, altering existing trade balances and creating disruption in supply chains. Countries such as China, the European Union, and Canada responded with their own tariffs on U.S. goods, marking an escalation in trade tensions and diminishing mutual economic benefits.

Trade partners have been compelled to reassess their economic strategies in light of these tariffs. Nations previously dependent on exports to the United States have sought to diversify their markets, either by enhancing trade with other economies or by fostering closer ties within regional groupings. This shift has led to a gradual realignment of trade agreements, as countries seek to minimize exposure to the uncertainties introduced by unilateral tariff measures. As a result, multilateral trade systems have come under strain, with nations questioning the efficacy of existing structures in facilitating free trade amidst rising protectionist sentiments.

Furthermore, the longer-term implications of these shifts are unfolding as countries adapt to a new trade reality. Structural changes in the global economy, influenced by tariff implementations, may lead to increased costs for consumers and businesses. These rising costs can dampen economic growth projections across various sectors, as companies may experience higher prices for imported goods and raw materials. Consequently, the effectiveness of tariffs as a tool for enhancing domestic economic performance is being scrutinized, prompting a reevaluation of their potential benefits against the backdrop of a more fragmented global trading system.

Conclusion: Future Outlook on Economic Growth

The imposition of tariffs by former President Trump has elicited substantial effects on the U.S. economy, influencing growth projections in multifaceted ways. While the intent behind the tariffs was to protect domestic industries and create jobs, the actual outcomes reveal a complex interplay of benefits and drawbacks. Increased costs of imported goods have impacted consumers and businesses alike, leading to adjustments in spending and investment patterns. Furthermore, retaliatory measures from trading partners have created additional challenges for U.S. exporters, underscoring the immediate implications of such protectionist policies on international trade dynamics.

As we look to the future, it is imperative to consider the existing economic challenges that persist in the post-tariff landscape. Factors such as inflation rates, labor market fluctuations, and supply chain disruptions remain critical considerations for policymakers. Future administrations may seek to reevaluate or revise existing trade policies in light of these ongoing economic conditions. The potential for policy adjustments could provide a more balanced approach to trade that supports both domestic industry and international cooperation.

Moreover, the long-term outlook for U.S. economic growth will heavily depend on the effectiveness of these policy responses. There is a growing consensus among economists that fostering an environment conducive to free trade and constructive bilateral relations is crucial for sustained growth. This suggests a need for comprehensive strategies that address the nuance of global trade while enabling domestic industries to flourish without the overshadowing impact of protectionist measures. As such, understanding the ramifications of the past and adapting to the evolving economic landscape will be essential for achieving robust economic growth in the years to come.

Finance & Investment

Trade Surveillance in Banking: Lessons from JPMorgan’s $348 Million Fine

Trade surveillance is a critical compliance function in banking and financial services that ensures the integrity of market activities and adherence to regulatory requirements. Effective trade monitoring helps prevent market abuses such as insider trading, front-running, and manipulation, protecting both investors and the broader financial system. Recently, JPMorgan Chase faced a substantial $348 million fine imposed by the Federal Reserve and the Office of the Comptroller of the Currency (OCC) due to inadequate trade surveillance controls. This high-profile penalty serves as a stark reminder to banks worldwide about the vital need for robust monitoring systems. Trade surveillance involves collecting and analyzing massive volumes of trading data in real time to identify suspicious behaviors or patterns that may indicate misconduct. As markets become more complex and trading volumes grow exponentially, financial institutions must invest heavily in surveillance technologies and governance frameworks to meet evolving regulatory expectations and safeguard their reputations.

The JPMorgan Case: What Went Wrong?

JPMorgan Chase’s penalty arose from several shortcomings in its trade surveillance program. Regulators found that the bank’s monitoring systems failed to adequately cover all trading venues and did not effectively analyze the full range of data needed to detect potential misconduct. Gaps in oversight allowed certain trading activities to go unchecked, increasing the risk of market abuses. Additionally, the bank’s controls were insufficient in preventing or identifying misconduct promptly, which is crucial for timely investigation and remediation. These deficiencies pointed to weaknesses in both technology infrastructure and internal governance. The case highlighted the consequences of inadequate surveillance, not only in terms of financial penalties but also reputational damage and potential loss of client trust. For financial institutions, the lesson is clear: trade surveillance cannot be an afterthought but must be a comprehensive, continuously updated program integral to daily operations.

Best Practices for Effective Trade Surveillance Systems

To avoid costly penalties and operational risks, banks need to implement trade surveillance systems that are robust, scalable, and adaptive. Best practices include integrating advanced analytics capable of processing large data sets across multiple trading platforms in real time. Machine learning and artificial intelligence technologies are increasingly being used to improve anomaly detection, reduce false positives, and provide compliance teams with actionable insights. Comprehensive surveillance programs also require strong governance frameworks that ensure clear roles, responsibilities, and accountability within the institution. Regular audits and continuous improvement cycles help identify gaps and adapt to new market practices or regulatory changes. Employee training and cultivating a compliance-oriented culture are equally important to ensure that staff understand surveillance requirements and actively support adherence. Transparency in reporting and effective communication with regulators can further enhance a bank’s ability to manage compliance risks proactively.

Technology’s Role in Enhancing Trade Surveillance

The complexity of modern financial markets demands that trade surveillance leverages cutting-edge technology solutions. Automated systems can monitor millions of trades, cross-referencing data from various sources such as order books, messaging systems, and market data feeds. AI-powered algorithms identify suspicious patterns that human monitors might miss and prioritize alerts for compliance teams to investigate. These technologies not only improve detection speed but also help reduce the burden of manual reviews, allowing staff to focus on high-risk cases. Additionally, cloud computing and big data architectures enable scalable storage and processing power essential for handling the volume and velocity of trade data. Implementing these technological advancements positions banks to meet stringent regulatory standards while maintaining operational efficiency and competitive advantage.

Strategic Takeaways for Banks and Financial Institutions

The JPMorgan fine underscores that trade surveillance is a critical area where banks cannot afford complacency. Financial institutions must treat compliance as a strategic priority, allocating sufficient resources to technology, people, and processes. Proactive investment in surveillance infrastructure not only reduces the risk of regulatory penalties but also enhances trust among clients and investors. Moreover, comprehensive trade monitoring helps detect internal control weaknesses and potential operational risks early, preventing larger issues. Institutions should conduct regular risk assessments to identify vulnerabilities and tailor surveillance parameters accordingly. Collaboration with regulators and industry groups can provide insights into emerging threats and best practices. Ultimately, integrating trade surveillance into the core of banking operations fosters a culture of integrity and resilience that benefits the institution and the financial markets as a whole.

Conclusion: Compliance as a Competitive Advantage

In conclusion, the JPMorgan Chase $348 million fine serves as a powerful cautionary tale for the banking sector, emphasizing the critical importance of effective trade surveillance. As financial markets evolve and regulatory scrutiny intensifies, banks must invest in sophisticated monitoring systems supported by advanced analytics and a strong compliance culture. Trade surveillance is not merely a regulatory obligation but a strategic tool that protects market integrity, strengthens client relationships, and mitigates operational risks. By learning from high-profile cases like JPMorgan’s, financial institutions can enhance their surveillance capabilities, avoid costly fines, and maintain their competitive edge in a complex and rapidly changing industry landscape. For banks committed to excellence, compliance and innovation must go hand in hand to build sustainable, trustworthy financial services for the future.

Economics

Asia’s Private Credit Boom: What It Means for Retail Investors

The Asia Pacific region is witnessing an extraordinary surge in private credit, transforming the financial landscape significantly. Private credit refers to direct lending to companies outside public markets, and over the last decade, this sector’s assets under management have grown from around $500 million to nearly $2 trillion. This rapid expansion is largely driven by emerging markets such as India and Australia, where businesses increasingly seek alternative financing solutions beyond traditional bank loans and public debt offerings. Historically, private credit has been dominated by institutional investors including pension funds and private equity firms. However, the landscape is evolving as retail investors gain access to this asset class through changing regulations, fintech platforms, and increased market demand. The expanding private credit market now offers retail investors an opportunity to diversify their portfolios and participate in an asset class that has demonstrated strong returns and resilience.

Why Private Credit Appeals to Retail Investors

Private credit has grown in popularity due to its potential to offer higher returns compared to traditional fixed-income investments such as government bonds or corporate debt. This is because private credit involves lending to companies with less liquidity and higher credit risk, factors that typically command a premium in yields. Retail investors often face challenges like low interest rates on savings and volatile stock markets, making private credit an attractive alternative for income generation and diversification. The growing involvement of financial giants such as JPMorgan Chase, which has recently allocated over $50 billion into the Asia Pacific private credit market, highlights the confidence that institutional investors have in the asset class. This institutional interest helps validate the opportunity for retail investors to explore private credit as part of a balanced investment strategy that supports both income goals and risk mitigation.

Regional Drivers Behind Asia’s Private Credit Boom

Asia’s private credit growth is closely tied to specific market conditions and regulatory environments within the region. In India, the tightening of banking regulations and a rise in non-performing assets have created a financing gap that private credit funds are actively filling. This has allowed companies to access capital through more flexible and tailored lending arrangements. Meanwhile, Australia’s advanced financial system and regulatory framework support a vibrant ecosystem of private credit funds and alternative lending platforms. These developments offer retail investors in these markets a variety of ways to participate in private credit. Investors can access this asset class through private debt mutual funds, alternative asset management platforms, and regulated digital lending marketplaces. Nevertheless, understanding the regulatory landscape and investment vehicle structures is critical to ensuring compliance and aligning investments with personal risk tolerance.

Key Risks and Considerations for Retail Investors

While private credit offers appealing opportunities, it is important for retail investors to be aware of its unique risks and challenges. Unlike publicly traded securities, private credit investments often involve longer lock-in periods during which liquidity is limited. This means investors may not be able to access their funds quickly, which could be a disadvantage for those requiring flexible cash flow. Additionally, private credit carries credit risk, meaning the possibility of borrower default can impact returns. Transparency is typically lower in private credit compared to public markets, so investors should diligently assess the quality and track record of the fund managers or platforms offering these investments. Understanding the underlying borrower profiles and loan terms is essential to mitigate potential losses. Fees can also be higher due to the complexity involved in underwriting and managing private loans. For these reasons, retail investors should perform comprehensive due diligence, seek professional advice, and only allocate a suitable portion of their portfolios to private credit.

The Role of Education and Professional Guidance

Given the complexities of private credit investing, education and expert advice are indispensable for retail investors. Keeping abreast of regulatory changes, market trends, and emerging opportunities is vital to making informed decisions. Awareness of how alternative investments are regulated in different countries within Asia Pacific helps avoid compliance issues and ensures access to legitimate investment products. Many financial advisors recommend that retail investors allocate a moderate portion of their investment portfolios to private credit as a way to enhance income and reduce correlation with traditional asset classes. However, this allocation should reflect an investor’s financial goals, risk appetite, and liquidity needs. Partnering with experienced fund managers or licensed investment platforms can provide additional safeguards and insights into this relatively complex market.

Supporting Regional Economic Growth Through Investment

Investing in private credit is not only about financial returns; it also plays an important role in supporting economic growth in Asia Pacific. Private credit financing helps small and medium enterprises (SMEs), startups, and infrastructure projects secure the capital they need to expand operations, innovate, and create jobs. Retail investors who participate in this market contribute indirectly to these positive economic outcomes, fostering development and entrepreneurship across the region. This dual benefit of combining financial gains with social impact adds an appealing dimension to private credit investment. It allows investors to align their portfolios with broader economic progress and community development goals, enhancing the meaning and satisfaction derived from their investments.

Conclusion: Unlocking Opportunities in Asia’s Private Credit Market

In summary, the Asia Pacific private credit boom offers an exciting and valuable opportunity for retail investors ready to explore alternative asset classes. The rapid market growth, strong institutional backing, and improving regulatory frameworks create a conducive environment for investment. However, retail investors must remain cautious and informed, understanding the risks related to liquidity, credit, and transparency. A well-researched and diversified approach, combined with professional guidance, can help investors unlock the benefits of private credit while managing potential downsides. As private credit continues to mature and gain accessibility, it is expected to become a vital part of diversified investment portfolios, offering both attractive financial returns and meaningful economic impact across the region.

Investing

Global Investor Outflows from U.S. Stocks & Dollar

In a shift that is sending ripples across financial markets, institutional investors around the world are pulling back from U.S. equities and reducing exposure to the U.S. dollar, signaling a significant change in sentiment toward American assets. According to the latest Bank of America Global Fund Manager Survey, global investors are now the most underweight on U.S. stocks in more than two decades, with the dollar facing similar skepticism as a long-term safe-haven asset. This transition is being fueled by multiple converging factors, including geopolitical instability, growing U.S. fiscal deficits, trade tensions, and an increasingly favorable investment climate in Europe and select emerging markets. For investors, economists, and policymakers alike, this trend represents a rebalancing of global capital flows that could reshape market dynamics in the months ahead.

Investor Sentiment Toward U.S. Markets Hits Multi-Year Lows

The Bank of America survey, considered a key barometer of global institutional sentiment, reveals that fund managers have turned heavily underweight on U.S. stocks and the dollar, preferring instead to rotate their portfolios into European and Asian equities. The survey showed that 36% of participants are now net underweight U.S. equities—the highest level since 2003. At the same time, positioning on the dollar turned net negative for the first time in over five years, with investors citing mounting fiscal concerns, valuation extremes, and weakening macroeconomic indicators.

The U.S. equity market, especially the tech-heavy NASDAQ, has experienced an extraordinary bull run over the last several years. But now, investors are questioning the sustainability of elevated valuations, particularly as economic growth slows, earnings forecasts are revised downward, and inflation remains persistently above target. Many portfolio managers believe the best returns may no longer be found in U.S. assets alone.

Rising U.S. Debt and Fiscal Deficits Raise Red Flags

A key driver of investor caution is the ballooning U.S. fiscal deficit. The Congressional Budget Office (CBO) projects that the U.S. federal deficit will reach over $1.8 trillion this year, driven by increased government spending, rising interest costs, and lower-than-expected tax revenues. The national debt is now projected to exceed 125% of GDP by 2030, raising serious questions about long-term fiscal sustainability.

Investors fear that soaring U.S. debt levels could lead to a loss of confidence in Treasury securities, pushing yields higher and triggering volatility in global credit markets. This concern is magnified by the growing political polarization in Washington, which has led to repeated debt ceiling standoffs and policy gridlock. As a result, some asset managers are choosing to diversify their bond portfolios with sovereign debt from countries like Germany, Canada, and Australia—nations viewed as having stronger fiscal discipline.

Geopolitical Tensions Erode Dollar Safe-Haven Appeal

The traditional role of the U.S. dollar as a global safe-haven currency is also being called into question. With the U.S. now embroiled in rising geopolitical conflicts, including its military engagement in the Middle East and an escalating trade war with China, the perception of the dollar as a “neutral” or stable currency is beginning to fade. Several countries, particularly in the Global South, have voiced frustration over the dominance of the dollar in international trade, and some have even accelerated efforts to settle trade in alternative currencies such as the euro, yuan, or local currency blocs.

In response, central banks in emerging markets are reducing their U.S. dollar reserves and increasing holdings in gold and non-dollar currencies. This trend, while gradual, is gaining momentum and contributing to the dollar’s underperformance against a basket of global currencies. The U.S. dollar index (DXY) has declined by nearly 6% year-to-date, reflecting both diminished investor confidence and a broader reconfiguration of reserve management strategies.

Attractive Valuations Abroad Drive Capital Outflows

While risks in the U.S. are mounting, attractive investment opportunities abroad are also contributing to the outflow of capital from American markets. European equities, particularly in sectors like green energy, luxury goods, and financial services, are seeing renewed interest thanks to relatively low valuations and improving macroeconomic stability. The recent ECB rate cuts and Eurobond discussions have added to optimism about the region’s fiscal and financial integration.

In Asia, countries like India, Indonesia, and Vietnam are emerging as new hotspots for foreign direct investment and equity inflows. These economies offer robust growth prospects, younger demographics, and increasingly tech-driven industries. Additionally, Japan’s bond market is seeing increased institutional buying, as long-term yields rise in response to the Bank of Japan’s policy changes.

This global diversification strategy is not just about seeking higher returns—it’s also about managing risk. Investors are increasingly looking to balance their portfolios geographically, reducing dependence on any single region and hedging against macroeconomic shocks that may be specific to the U.S.

Currency Hedging and Diversification as Defensive Strategies

In response to the dollar’s volatility, many fund managers are now engaging in currency hedging strategies to protect their portfolios. Currency ETFs, options, and forward contracts are being used to minimize the downside risk of a weakening dollar. At the same time, global investment funds are ramping up their exposure to non-dollar-denominated assets, including eurozone corporate bonds, emerging market debt, and local-currency sovereign issues.

Moreover, ESG and green bond markets in Europe and Asia are attracting capital due to their alignment with global sustainability goals. These instruments not only offer diversification but also align with broader institutional mandates on responsible investing.

Implications for U.S. Markets and Monetary Policy

The capital flight from U.S. assets could have significant implications for American markets. A persistent decline in foreign demand for U.S. Treasuries may force the Federal Reserve to intervene more frequently in the bond market to maintain liquidity and control yields. At the same time, a weaker dollar could contribute to imported inflation, complicating the Fed’s efforts to bring core inflation back within its target range.

On the equities side, if investor outflows persist, U.S. companies may face higher capital costs and declining valuations, particularly in sectors that rely heavily on foreign investment or exports. Domestic pension funds and institutional investors may need to fill the gap left by global investors, which could further alter asset allocation strategies and influence corporate financing decisions.

A New Era of Global Capital Rotation

The growing shift away from U.S. stocks and the dollar signals the beginning of a new era in global investing, one defined by diversification, geopolitical hedging, and currency rebalancing. While the U.S. remains a central player in global finance, the days of unquestioned dominance are beginning to fade, as investors embrace a more nuanced and distributed view of risk and opportunity.

For market participants, staying agile in this environment means tracking global fund flows, monitoring geopolitical developments, and reassessing the traditional U.S.-centric portfolio model. As capital continues to flow into European and Asian markets, the future of global finance is being rewritten—and those who adapt early may find themselves ahead of the curve.

-

Finance & Investment8 months ago

Finance & Investment8 months agoEmerging Markets to Watch in 2025: Opportunities and Risks

-

Technology and Finance9 months ago

Technology and Finance9 months agoThe Future of Quantum Computing in Financial Modeling and Trading

-

Finance9 months ago

Finance9 months agoUSA Market Trends & Global Finance Insights

-

Finance9 months ago

Navigating Retirement in the Gig Economy: Challenges and Solutions

-

Finance9 months ago

Finance9 months agoNavigating Personal Finance in the Age of Inflation and High Interest Rates

-

Economics8 months ago

Economics8 months agoGlobal Markets React to U.S. GDP Contraction: A Comprehensive Analysis

-

Finance9 months ago

Finance9 months agoDecentralized Finance (DeFi): Opportunity or Risk? A Deep Dive into the Rise of DeFi Platforms and Their Challenge to Traditional Finance

-

Finance9 months ago

Finance9 months agoTop 10 High-Yield Savings Accounts in the US (2025 Edition)